True to its commitment in continuous improvement to provide a full cycle accounting software, First BIT released two new modules to help accountants and finance professionals manage their deferrals. One of the challenges encountered by businesses is adjusting the entries in their financial statements for expenses or revenues that are acquired but have yet to pay or receive.

Mentioned below are the two reasons for deferrals:

1. Report an expense to be incurred in the following months, while the transaction had been recorded in the accounts of the current month.

2. Report a revenue to be earned in the following months, but the transaction had been recorded.

With the new add-on modules for FirstBIT Accounting, accounting for deferrals is streamlined and automated.

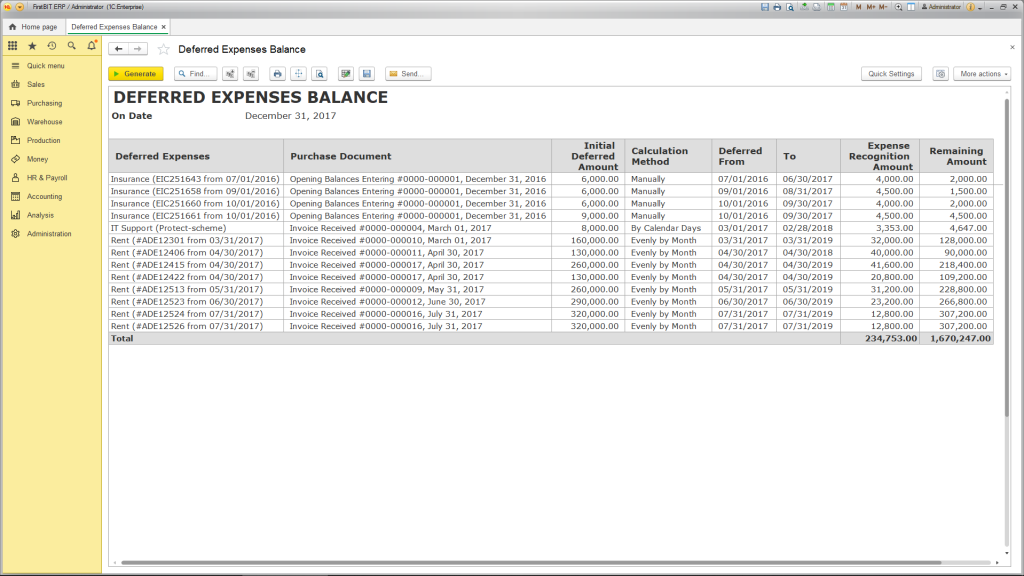

Deferred Expense

When to Defer Expense: If you received an invoice for services to be rendered during multiple subsequent months, you should define the purchase amount as a deferred expense. In this case, expenses will be recognized each month during which services are rendered.

Examples of deferred expenses: expenses on insurance and IT support, expenses on lease agreements, and so forth.

Core Features:

• Deferral creation at the time of purchase;

• Flexible deferral parameters;

• Automatic expenses recognition during the month-closing process;

• Manual adjustment of amounts to be recognized as expenses;

• Analysis of deferred expenses.

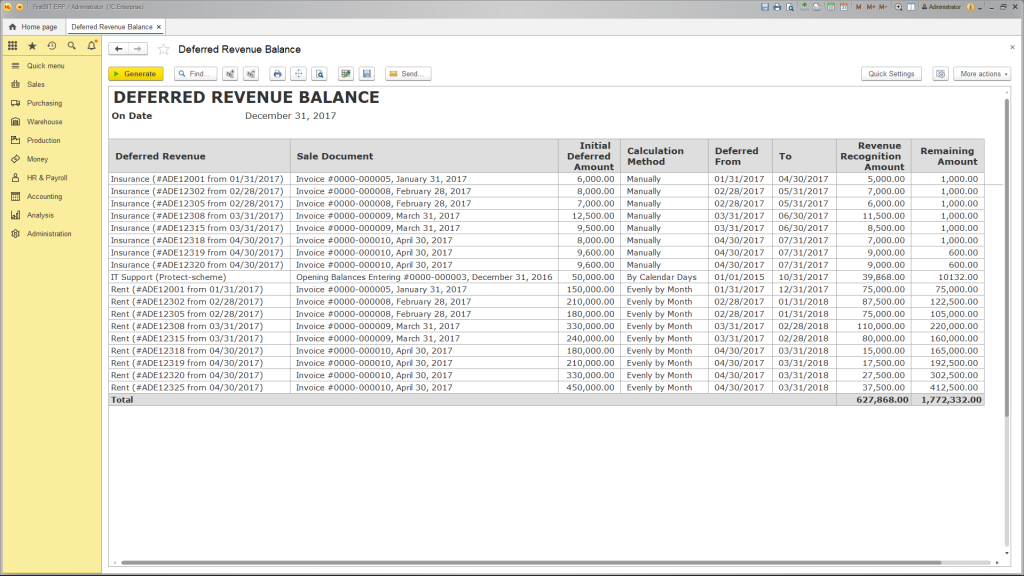

Deferred Revenue

When to Defer Revenue: If you have issued an invoice for services that will be provided during multiple subsequent periods, you should define the sales amount as a deferred revenue and recognize this sale revenue in portions each period as the services are provided.

Examples of deferred revenues: revenue from insurance contracts, IT support, lease agreements, and so forth.

Core Features:

• Deferral creation at the time of sale;

• Flexible deferral parameters;

• Automatic income recognition during the month-closing process;

• Manual adjustment of amounts to be recognized as revenue;

• Analysis of Deferred Revenue.

Learn how deferred expense and deferred revenue modules can help your business.

Contact us at +971 639 69 69