On October 2, 2017 UAE Council of Ministers adopted Cabinet Resolution No. (40). – resolution on administrative penalties for violations of VAT law in the UAE. This article analyses the most common mistakes which may cause penalties.

During a sale operation or when receiving a prepayment you have not issued Tax Invoice to your customer (or have issued an incorrect one). – 5,000 AED per each not issued (incorrect) Tax Invoice.

According to the law you must provide your customer with a Tax Invoice during 14 days after the sale or getting prepayment. The Tax Invoice must contain information prescribed by the law. If the information in the Tax Invoice is incomplete, the Tax Invoice will be considered incorrect. Penalty amount for an incorrect Tax Invoice is equal to penalty amount for Tax Invoice absence.

During a goods or prepayment return operation you have not issued a Tax Credit Note (or have issued an incorrect one) to your customer. – 5,000 AED per each not issued (incorrect) Tax Credit Note.

According to the law you must provide your customer with a Tax Credit Note at the moment of returning goods or prepayment. The Tax Credit Note must contain information prescribed by the law. If the information in the Tax Credit Note is incomplete, the Tax Credit Note will be considered as incorrect. Penalty amount for an incorrect Tax Credit Note is equal to penalty amount for Tax Credit Note absence.

Your price labels (price-list) show VAT exclusive prices. – 15,000 AED.

According to the law all the prices used for commercial purposes must be set VAT inclusive.

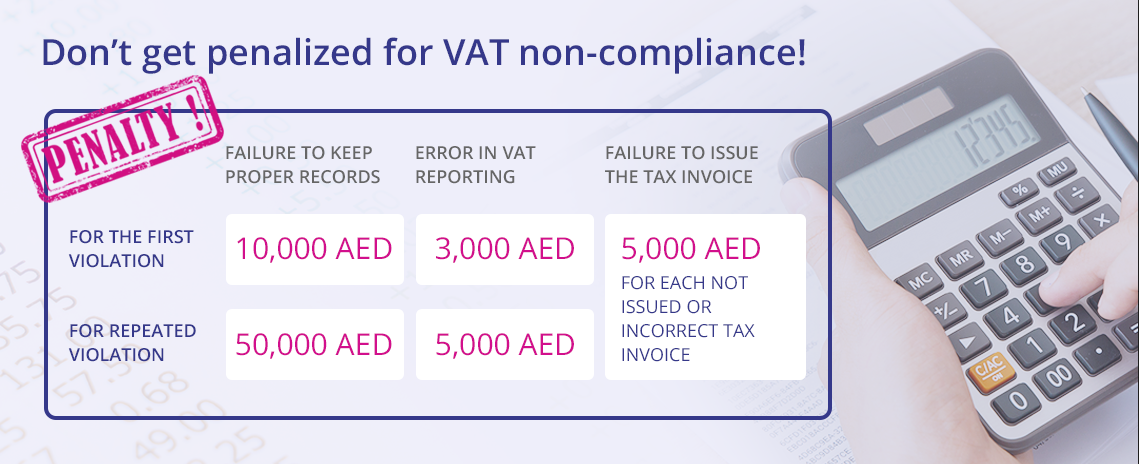

You have submitted incorrect VAT Return. – 3,000 AED for the first time, 5,000 AED in case of repetition + percentage based penalties (from 5% to 50% off the VAT amount unpaid due to the error).

According to the law you must submit VAT Return not later than 28 days after the end of tax period. VAT Return has to be filled in and confirmed in the FTA e-Services Portal. Calendar of tax periods is set individually for each organization. You can see your tax periods in your taxpayer's account.

You have failed to pay VAT within the set time frame or have paid incorrect VAT amount. – From 2% to 300% off unpaid VAT amount depending on the delay time.

According to the law you must pay VAT not later than 28 days after the end of tax period. VAT payment has to be done in the FTA e-Services Portal using an e-Dirham or a credit card (Visa or MasterCard). Calendar of tax periods is set individually for each company. You can see your tax periods in your taxpayer's account.

During a tax audit you have not provided accounting records. – 10,000 AED for the first time, 50,000 AED in case of repetition.

According to the law you are obliged to maintain accounting records. Minimal amount of accounting records and reports is prescribed by the law. It is necessary to keep accounting records for 5–15 years (depending on type of activities and individual FTA requirements).

For the complete list of penalties and their details, please see Cabinet Resolution No. (40) (link to an attached document).